georgia ad valorem tax out of state

The Ad Valorem Tax or the Property Tax is based on value. After that you paid annual ad valorem tax at a lower rate.

Cook County Il Property Tax Calculator Smartasset Retirement Calculator Retirement Strategies Savings And Investment

The administration of tax exemptions is as interpreted by the tax commissioners of Georgias 159 counties.

. Two common vehicle taxes implemented in this state are the Title Ad Valorem Tax and the Annual Ad Valorem Tax. New residents moving into Georgia are required to register and title their vehicle in Georgia and must pay TAVT in an amount equal to 3 of the fair market value of their vehicles. As a result the annual vehicle ad valorem tax sometimes called the birthday tax is being changed to a state and local title ad valorem tax or TAVT.

Ad Valorem Vehicle Taxes If you purchased your vehicle in Georgia before March 1 2013 you are subject to an annual tax. Rental tax and lodging tax. Legislation enacted by the Georgia General Assembly in 2012 created a new system for taxing motor vehicles.

Use Ad Valorem Tax Calculator. In this example multiply 40000 by 066 to get 2640. You can calculate the Title Ad Valorem Tax by finding the fair market value of the vehicle and multiplying it by 66.

Currently 50 out of the 1079 zip. There is no sales tax in the state of GA but an Ad Valorem tax is paid when the car is. Georgia Registration Ad Valorem Tax I am purchasing a vehicle through Carvana in the state of GA.

If you are a new Georgia resident you are required to pay a one-time title ad valorem tax title tax of 3. Vehicles purchased on or after March 1 2013 and titled in Georgia are exempt from the sales and use tax and the annual ad valorem. Motor vehicles registered in Georgia.

Cars Purchased On or After March 1 2013. The Property Tax is part of a well balanced revenue system that is designed to spread the tax burden to all citizens who benefit. GDVS personnel will assist veterans in obtaining the necessary documentation for.

The Ad Valorem calculator can also estimate the tax due if you transfer your vehicle to Georgia. Learn how Georgias state tax laws apply to you. Individuals 65 years of age or over may claim a 4000 exemption from all state and county ad valorem taxes if the income of that person and his spouse does not exceed 10000 for the.

As a result the annual vehicle ad valorem tax. This calculator can estimate the tax due when you buy a vehicle.

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Cypress Texas Property Taxes What You Need To Know Property Tax Tax Attorney Tax Lawyer

It Doesn T Matter Whether You Are Investing On Real Estate Or Shares As Long As Our Small Business Consulting Business Consultant Services Accounting Services

![]()

Georgia New Car Sales Tax Calculator

Business Personal Property Tax Return Augusta Georgia Property Tax Personal Property Tax Return

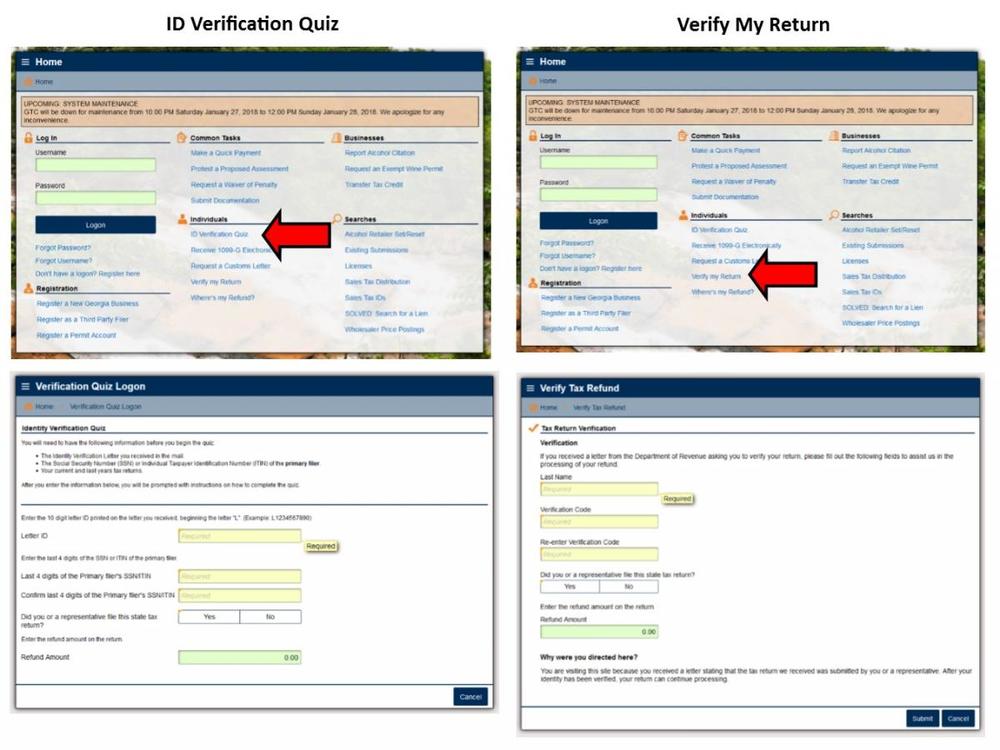

Return Verification Id Verification Quiz Georgia Department Of Revenue

Property Tax Map Tax Foundation

Georgia Used Car Sales Tax Fees

Georgia Redeemable Tax Deed State House Deeds The Deed How To Find Out

Economics Taxes Economics Notes Accounting Notes Business Notes

How Property Taxes Can Impact Your Mortgage Payment Property Tax Mortgage Payment Mortgage

Which States Have The Lowest Property Taxes Property Tax American History Timeline Usa Facts

Median Household Income And Taxes State Tax Levels In The United States Wikipedia Utah Enderal

Vehicle Taxes Dekalb Tax Commissioner

What Are Ad Valorem Taxes Henry County Tax Collector Ga

Pin By Kirunda Group Corp On Real Estate Investing Being A Landlord Real Estate Investing Property Tax

State By State Guide To Taxes On Retirees Retirement Income Income Tax Tax Free States